MRA e-Invoicing System

MRA is introducing an e-Invoicing system at the national level in Mauritius in a phase-wise approach. With the advent of this e-Invoicing system, providers of products and services will be required to fiscalise their invoices or receipts in real time with the MRA before issuing them to their customers.

In general, an economic operator makes use of an Accounting Package / Invoicing Solution / POS / ECR / ERP, also referred to as an Electronic Billing System (EBS), in order to invoice its customers for the sales made.

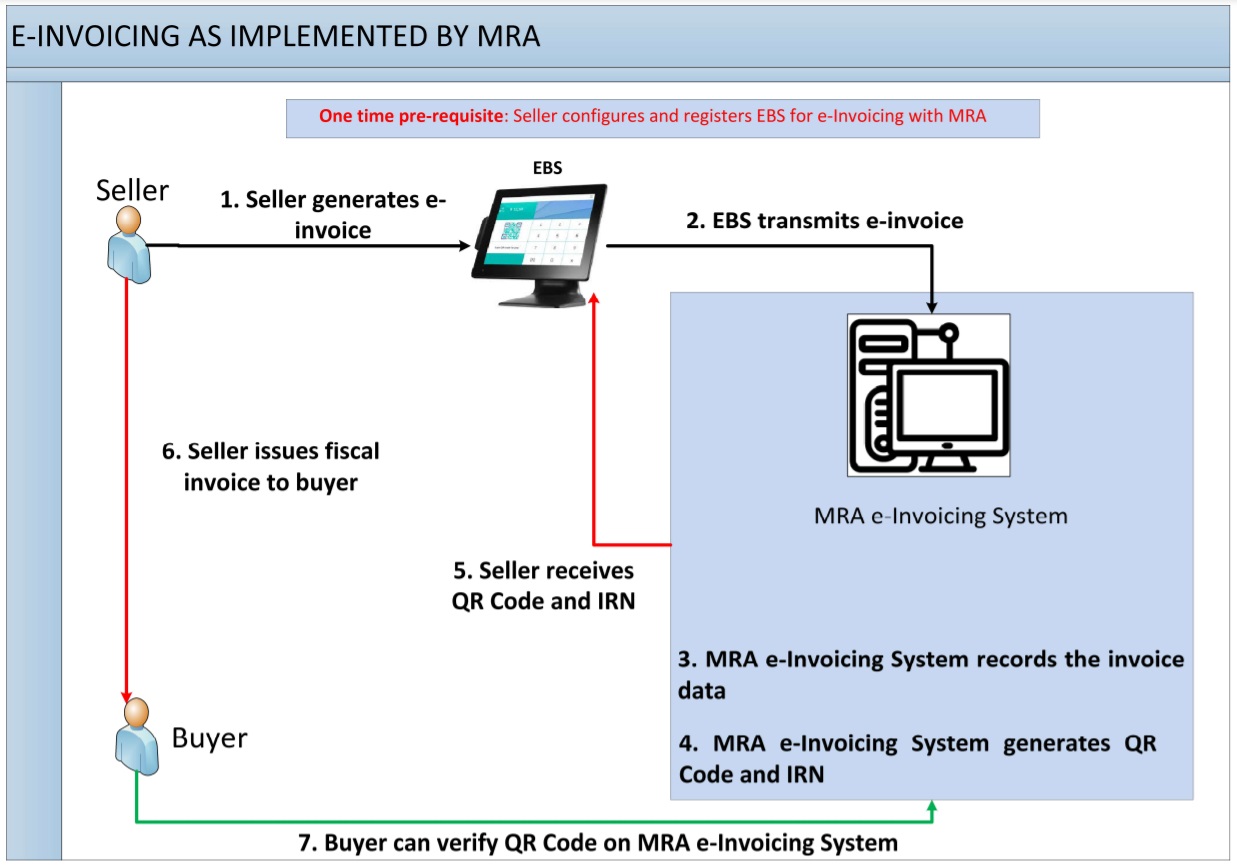

The following diagram gives a pictorial representation of the MRA e-Invoicing System:-

The various external stakeholders and their roles in this national e-Invoicing initiative are:-

| S/N | Stakeholder | Role | Effective Date |

| 1 | EBS software developers and solution providers | Register, customise, test and self-certify their EBS for compliance with the MRA e-Invoicing system | 26th June 2023 |

| 2 | Economic Operators who issue invoices | On-board compliant EBS and issue fiscalised invoices / receipts | Beginning of 2024 in stages |

| 3 | The customers of the economic operators (including the general public) | Check if received invoices / receipts have been fiscalised by MRA | Beginning of 2024 |

The benefits of the e-Invoicing system include:

-

promotion of a level playing field;

-

keeping up to date with the current worldwide evolution in taxation;

-

fostering business transparency with external stakeholders;

-

boosting technological readiness of economic operators to exchange invoices in real time and;

-

promoting the image of Mauritius as a good place to do business as well as improving tax compliance.

Phase 1

Phase 1 of the e-Invoicing system went live in June 2023 whereby EBS software developers and EBS solution providers, through the MRA e-Invoicing Developer Portal, were required to register, customise, test and self-certify their EBS for compliance with the MRA e-Invoicing system.

This initial phase is mainly targeted for software developers

-

who work for EBS manufacturers / solution providers or,

-

other than those in (a) above who work for the in-house ICT department of a public or private organisation using an EBS for issuing invoices or receipts.

Phase 2

Economic Operators must, after they have customised their EBS to be compliant with MRA’s e-Invoicing specifications, register themselves for e-invoicing on the MRA e-Invoicing Portal. Some tests prescribed on the Portal must be carried out successfully. Thereafter, Economic Operators must on-board their EBS on the e-Invoicing Portal before it may be used to issue fiscal invoices An EBS MRA ID will be generated after successful registration of an EBS on the Portal. An EBS MRA ID is a unique ID which identifies an EBS and which is used for live transmission of invoices.

Phase 3

This phase concerns mandatory issue of fiscal invoices by Economic Operators which will be implemented in stages. In the first stage, Economic Operators having an annual turnover exceeding Rs 100 million will be required to join the MRA e-Invoicing system. The first stage for mandatory issue of fiscal invoices is scheduled to take effect on 15 May 2024.

e-Invoicing will then be extended progressively to other taxpayers.

|

MRA e-Invoicing Portal For EBS Solution Providers / Software Developers & Economic Operators

|

-

Contact Us

-

Phone : 207 6020

-

eMail : This email address is being protected from spambots. You need JavaScript enabled to view it.

-