Internal Affairs

Since its inception MRA’s has always valued the importance of upholding a culture of integrity amongst both its internal and external stakeholders. Two dedicated Divisions (Internal Audit and Internal Affairs) have been set up under the MRA Act for fostering a sound integrity management within the organisation.

The Internal Affairs Division is mandated to deal with allegations of malpractice against employees, process and verify the declaration of assets made by an officer with a view to ensuring that accretion of their wealth is not attributable to any illicit enrichment.

The Division performs its statutory duties within the broader concept of integrity management at MRA, which includes among others:

- Pre-employment integrity checks on Staff;

- Verification of declaration of assets made by officers and employees of the MRA subject to complaints;

- Educate staff and stakeholders on ethics and integrity;

- Undertake vigilance activities at the workplace to uncover irregularities / malpractices through surprise visits / inspections / checks / reviews.

Fiscal Investigations

One of the functions of the Mauritius Revenue Authority is to combat fraud and other forms of tax evasion. To achieve this objective, the Fiscal Investigations Department (FID) has been set up by virtue of Section 3(4) of the MRA ACT 2004.

Fiscal Investigations Department (FID) conducts investigations into potential tax-evasion cases, collects evidence relative to these cases, raises assessments and recommends prosecution for certain types of offences.

For the purpose of ascertaining the tax liability of a person, Section 15 of the MRA Act also empowers the Fiscal Investigations Department (FID) to:

- enter any premises where any business is carried out;

- require any person to produce any record, bank statement or other document

- make a copy of any record, bank statement or other document found on premises

- retain or seize any record, bank statement or other document

Anti-Money Laundering / Combating the Financing of Terrorism (AML/CFT)

-

Following the publication of the Mutual Evaluation Report on Mauritius in July 2018 which assessed the level of technical compliance and effectiveness of Mauritius’ AML/CFT system with the Financial Action Task Force (FATF) standards, recommendations were formulated on how the system could be strengthened.

-

The key recommendations for MRA were as follows:

-

Make more effort to conduct parallel ML investigations alongside investigation of predicate offences.

-

Investigate and prosecute tax evasion as a predicate offence of ML and not just concentrate on tax assessment and revenue collection.

-

-

In line with the above, in February 2020, the AML/CFT Unit has been set up within the Fiscal Investigations Department (FID) to identify, investigate and prosecute tax evasion cases having a money laundering limb. MRA works in close collaboration with other Law Enforcement Authorities (LEAs) to assist them in the common objective to deter money laundering, as recommended by the Financial Action Task Force (FATF).

-

The objectives of the Unit are to:

-

Carry out investigation into cases suspected of tax evasion;

-

Refer cases of tax offences to LSD for prosecution;

-

Refer cases of Money Laundering and Financing of Terrorism for Money Laundering (ML) and Terrorist Financing (TF) investigations to ICAC and other Law Enforcement Agencies (LEAs) respectively and for prosecution if applicable; and

-

Comply with the FATF Recommendations and other international standards as regards investigation and prosecution of tax evasion cases.

-

-

Amendments have been brought to the Mauritius Revenue Act by the Finance Act 2021 so that information in relation to money laundering offences will now be exchanged with the Mauritius Police Force (MPF), the Integrity Reporting Services Agency (IRSA) and the Asset Recovery Investigation Division (ARID).

-

The MRA has also signed Memorandums of Understanding with the Financial Services Commission (FSC), the FIU and ICAC to facilitate exchange of information and referral of cases.

-

The regulatory and supervisory bodies falling under the Financial Intelligence and Anti-Money Laundering Act (FIAMLA), such as the Corporate and Business Registration Department (CBRD), the FSC amongst others also share and exchange information with the MRA in suspected cases of tax evasion.

Stay of Assessment in Prosecution Cases and Parallel Investigations

Under:

- Sections 123A and 130 of the Income Tax Act (ITA);

- Section 7A of the Customs Act; and

- Section 119A of the Gambling Regulatory Authority Act

the Director General (DG) of the MRA shall not make an assessment in respect of a period beyond 3 years of assessment preceding the year of assessment in which a return of income is made or a validated bill of entry is passed or liability to pay duty or tax arose, respectively.

However, where a return of income has not been submitted or where fraud has been established, the DG may make an assessment at any time.

Similarly, under Section 28A and Section 37(3) of the Value Added Tax Act (VAT Act), the DG shall not make any assessment in respect of a period before 4 years preceding the last day of the taxable period unless the person has:

-

demonstrated fraudulent conduct;

-

wilfully neglected to comply with the VAT Act;

-

not submitted a return under section 22 or section 23 of the VAT Act

In most cases, taxpayers who have not declared and have not paid the correct amount of tax, would be issued with a Notice of Assessment instructing them to pay the taxes due and payable inclusive of penalties and interest or if aggrieved to object against the assessment issued. As such, taxpayers would normally expect the MRA to issue a Notice of Assessment within the time limit specified under Section 130 of the ITA and Section 37(3) of the VAT Act unless in the case of fraud or when a return of income/VAT has not been submitted.

However, under Section 15A of the MRA Act, if cases have been referred:

-

for prosecution to LSD in respect of offences committed under Section 147 of the ITA, Section 58 of the VAT Act, Section 148(4) or (5) of the Gambling Regulatory Authority Act or Section 131A or 158(1)(b) or (3)(a), (b) or (c) of the Customs Act;

-

to the ICAC for Money Laundering (ML) offence committed in respect of offences referred at (1) above,

the DG may stay the assessment to be raised in these cases.

Under such circumstances, the time limit to issue assessment, would not be as specified under Section 130 of the ITA and Section 37(3) of the VAT Act, but would be for an additional period of 2 years from the time limit imposed under Section 130 of the ITA, Sections 28A and 37(3) of VAT Act, Sections 119 and 119A of the Gambling Regulatory Authority Act and Sections 7A, 15 and 24A of the Customs Act.

Mr. M. Sudhamo Lal, G.O.S.K, C.S.K, Director-General of the MRA

Mr. M. Sudhamo Lal is the Director-General of the Mauritius Revenue Authority (MRA) since 2005. He has several years of successful experience in sharing fiscal, strategic and operational leadership skills in revenue agencies. He has led a complete organisational transformation, with the merging of four revenue departments into an integrated revenue administration. He continually and successfully strived to implement the tax reform programme and has instilled a high performance culture at the MRA through a new Human Resources Framework based on performance and efficiency, along with a flattening of the organisational structure.

Mr. M. Sudhamo Lal is the Director-General of the Mauritius Revenue Authority (MRA) since 2005. He has several years of successful experience in sharing fiscal, strategic and operational leadership skills in revenue agencies. He has led a complete organisational transformation, with the merging of four revenue departments into an integrated revenue administration. He continually and successfully strived to implement the tax reform programme and has instilled a high performance culture at the MRA through a new Human Resources Framework based on performance and efficiency, along with a flattening of the organisational structure.

Prior to working with the MRA, he worked in direct tax administration in Pakistan, progressing from Commissioner of Income Tax and Wealth Tax and Director-General (Withholding taxes), to member (Tax Policy and Administration) in the Central Board of Revenue, Islamabad. In this role, he was responsible for leading a US$150 million World Bank funded tax administration reform programme and interacted with the European Union, Asian Development Bank, International Monetary Fund (IMF) and other international finance institutions.

Mr. Lal acted as President of the Commonwealth Association of Tax Administrators (CATA) from 2009 to 2012, Vice Chairman for the World Customs Organization’s Eastern and Southern Africa Region from 2011 to 2013. He was elected Council Member of the African Tax Administration Forum (ATAF) in September 2014 and in November 2015 he was elected Chairman of CATA for three years. In October 2016, Mr. Lal was elected to serve as Vice-Chairman of ATAF for two years. This vice-chairmanship was renewed in October 2018. In November 2018, Mr. Lal was again elected President of (CATA) for a period of three years.

In March 2018, Mr. Lal was elevated to the rank of Commander of the Order of the Star and Key of the Indian Ocean (C.S.K) in recognition of his contribution in the administration and collection of taxes.

In March 2024, Mr. M. Sudhamo Lal was conferred the award of Grand Officer of the Order of the Star and Key of the Indian Ocean (G.O.S.K) in recognition of his significant contribution in the administration and collection of taxes, by President of the Republic of Mauritius.

MRA Organisational Chart

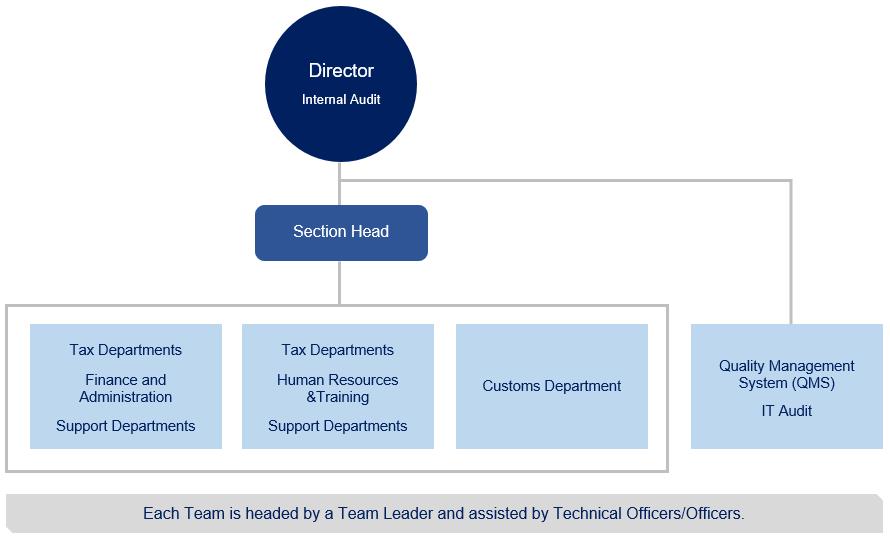

Internal Audit Function

The objective of the Internal Audit Division is to provide independent and objective assurance and advisory services to the Board and Management on risk management, internal control and governance. The Division also oversees and audits the MRA Quality Management System.

Internal Audit adds value and improves operations of the MRA by systematically evaluating and recommending improvement and implementation of best practices.

In line with the Internal Audit Charter, the Internal Audit Division has full, free and unrestricted access to all functions, records, property and personnel of the organization, pertinent to carrying out any engagement.

The Division is headed by a Director who reports administratively to the Director-General and functionally to the Audit and Oversight/Risk Management Committee.

Key members of Internal Audit function are holders of relevant and diverse qualifications, which include amongst others FCCA, MBA, Masters in IT & IT Security, CIA (Certified Internal Auditor), CISA (Certified Information System Auditor), Postgraduate in Corruption Studies and ISO 9001 Lead Auditor.

The Internal Audit Team consists of 19 officers (1 Section Head, 4 Team Leaders, 8 Technical Officers and 6 Officers) and the Division is structured as follows:

|

The Global Guidance Setting Body |

In 2022, in line with IIA requirement, the Division has undergone an External Quality Assessment (EQA). The assessment concluded that the Internal Audit function conforms to the IIA Standards and the Code of Ethics. This conformance remains valid for a period of five years. The above assessment adds to the credibility and professionalism of MRA’s Internal Audit function. |